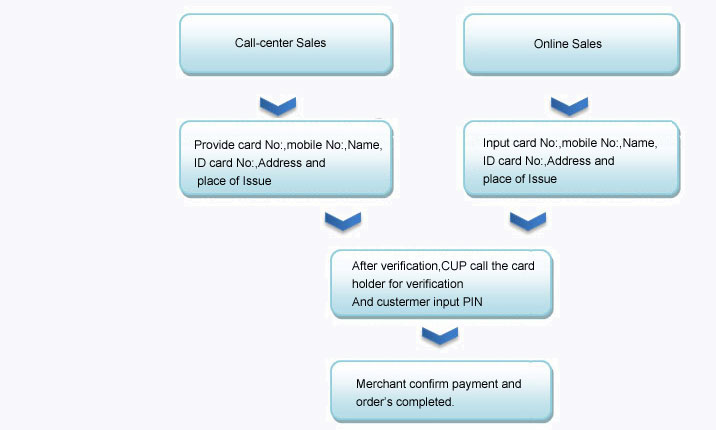

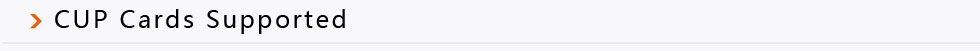

DNA (Digital Network Authorization) technology is the "Real-time non-cash payment methods and equipment anti-theft security system". CUP DNA Mobile Payment platform adopted "DNA patented technology" which built along with the CUP payment network. The payment system connects with merchant's transaction system through the Internet or WAP, on the other hand, it links with the telecom operators' voice and SMS gateway connectivity by telecom operators to provide dedicated voice channels. When any CUP card holders and merchants have completed the ordering process, the payment is confirmed by DNA technology when the card holders receive the call from dedicated phone number (020-96585) voice calls, the transaction details is broadcasted, and the card holders just need to enter the PIN to confirm the payment request, ?and then complete the payment process.

Since 2003, DNA technology has been successfully applied by banks including:

Due channels secured payment method

During doing the transactions, user's bank account information and the PIN information are traveled through different channels on a real-time mode, completely avoid user's information being intercepted at the same time. After transaction, it does not leave any footprint in the terminals and the system that provide a highly secured payment solution.

Due channels secured payment method

During doing the transactions, user's bank account information and the PIN information are traveled through different channels on a real-time mode, completely avoid user's information being intercepted at the same time. After transaction, it does not leave any footprint in the terminals and the system that provide a highly secured payment solution.

Simple and convenient payment

the users just need to simply answer the call and key in the PIN. It provides the best alternative secured, convenient and real-time payment solutions to those users not use Internet and credit cards.

Simple and convenient payment

the users just need to simply answer the call and key in the PIN. It provides the best alternative secured, convenient and real-time payment solutions to those users not use Internet and credit cards.

Low-cost and fast payment

DNA Mobile Payment platform provides merchants a unified interface; merchants could simply linkup the payment platform through Internet, and then can receive money from bank cards under off-line condition.

Low-cost and fast payment

DNA Mobile Payment platform provides merchants a unified interface; merchants could simply linkup the payment platform through Internet, and then can receive money from bank cards under off-line condition.

Payment on the Virtual POS

DNA Mobile Payment subsidizes the shortage from POS, Internet Banking, which extends the services distance and make it available for debit card payment.

Payment on the Virtual POS

DNA Mobile Payment subsidizes the shortage from POS, Internet Banking, which extends the services distance and make it available for debit card payment.

- E-tickett

- Top-up Service

- Public Utilities

- Insurance

- E-Commerce

e-Commerce becomes more and more popular as the major sales channel for the Corporate.

Consumers have built trustworthiness with e-payment which getting popular for internet settlement,whereas cash-on-delivery is getting less importance.

e-payment method is mainly through Internet payment whereas credit card payment is mainly for call center sales

Speed of payment process is the critical factor for airline ticketing industry

Create a new way of debit card payment for call centers which can supplement to payment by credit card and COD and could expand the scale of business of call center sales

Enhance Improve the efficiency of ticketing sales

Providing the integrated real-time services including queries, reconciliation and refund. Enhancing an efficiency of ticket booking and cut down the operating cost.

Top-up services consists of a recharge of virtual account and lottery account, prepayment of mobile phone, and other online game's point card;

Most Internet users accept and use online bank services to top-up their Virtual account and game's cards;

Phone top-up business mainly rely on prepaid card recharge, air re-fill and sales networks;

Top-up services have a special need of security, effectiveness and financial/cash flow arrangement.

Top-up services by using bank debit card is effectively improved efficiency of collection, reconciliation, enquiry and real time services.

Public utility bills includes water, electricity, gas, fines, taxes, vehicle annual fee, subscription fees for television and Internet,

Traditional forms of payment involve high social resources, personnel and equipment investment, operating costs;

General public accepts e-payment methods where online payment is getting popular;

Payment services through call center may not applicable;

Call center (manual or IVR) can be used to fulfil a variety of payment services which providing one-stop telephone bill payment services;

Single access can offer online and call centers payment by using for the debit card;

Save resources and lower operating costs;

Mobile payment is a simple and easy payment method to introduce to the public.

Insurance industry requests the receive of premiums shall be on the "no cash" basis; all major insurance companies have offered online sales;

Online payment of premiums is convenient and ,generally accepted by the insured; most call centers only offer enquiry services;

Offering POS machine with the function of DNA Mobile Payment to the insurance agents ;

Online insurance and settlement can eliminate the need of middleman that reducing the operating costs of sales;

Call center can offer the real time remote payment by using debit card when needs;

Internet and telephone sales are getting popular, the number of users has exceeded 100 million;

Many method to pay for the sales on Internet and telephone, most of them support third-party payment platform, credit cards, etc.;

The security of transactions and user's data are most concerned;

The user concerns more on branding, security and convenience of the third-party payment operators;

Offering the new real time payment channel by using debit cards;

Enlarged the user's group;

Secured the user's and transaction data;

Merchants can save up the cash of the credit card's deposit ;

Users can confirm payment of services instantly;

Simple connection

Cross banks and cross telecom operators

Secured payment method

Minimize the operating risks with minimal costs

- 1. Interested Merchants can call (20) 22132804 or (20) 22132811 for enquiry.

- 2. After agreed with the terms, merchants shall submit copies of business licenses and related information for the Company and CUP together with the application form for review.

- 3. The Company will sign a services contract with the merchant after checking the application form, related qualification and information. Then will send the information to the CUP for further verification.

- 4. After verification by the CUP, the Company will create an account and provide related technical documents to the merchants for setting up the system interfatece.

- 5. The Company will provide trainings and technical supports.

- 6. DNA Mobile Payment system will be online after the merhcant's account is activated.

Due channels secured payment method

During doing the transactions, user's bank account information and the PIN information are traveled through different channels on a real-time mode, completely avoid user's information being intercepted at the same time. After transaction, it does not leave any footprint in the terminals and the system that provide a highly secured payment solution.

Due channels secured payment method

During doing the transactions, user's bank account information and the PIN information are traveled through different channels on a real-time mode, completely avoid user's information being intercepted at the same time. After transaction, it does not leave any footprint in the terminals and the system that provide a highly secured payment solution.

Simple and convenient payment

the users just need to simply answer the call and key in the PIN. It provides the best alternative secured, convenient and real-time payment solutions to those users not use Internet and credit cards.

Simple and convenient payment

the users just need to simply answer the call and key in the PIN. It provides the best alternative secured, convenient and real-time payment solutions to those users not use Internet and credit cards.

Low-cost and fast payment

DNA Mobile Payment platform provides merchants a unified interface; merchants could simply linkup the payment platform through Internet, and then can receive money from bank cards under off-line condition.

Low-cost and fast payment

DNA Mobile Payment platform provides merchants a unified interface; merchants could simply linkup the payment platform through Internet, and then can receive money from bank cards under off-line condition.

Payment on the Virtual POS

DNA Mobile Payment subsidizes the shortage from POS, Internet Banking, which extends the services distance and make it available for debit card payment.

Payment on the Virtual POS

DNA Mobile Payment subsidizes the shortage from POS, Internet Banking, which extends the services distance and make it available for debit card payment.